Crypto Assets:

A Sensible Investment

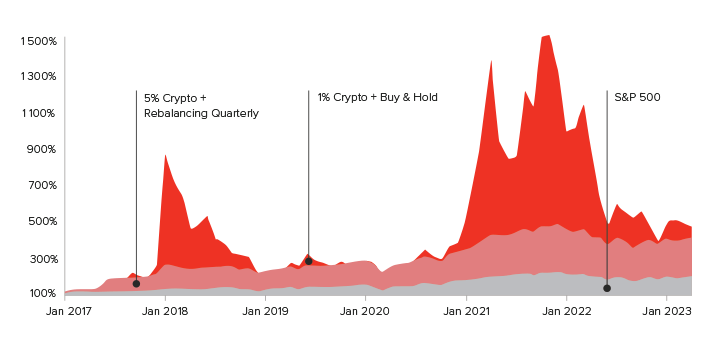

The crypto market has the potential for exponential growth. A highly asymmetric risk return profile and uncorrelated behaviour makes crypto an exciting asset class.

Navigate the Emerging Crypto Market With SwissOne Capital

SwissOne Capital is an investment advisor specialising in Crypto Assets. We are focused on creating sensible investment products to drive value for our clients.

Trusted Expertise

Our licensed fund managers and executive team exemplify Swiss excellence, with decades of managing assets for institutional clients.

Stringent Security

SwissOne assets are secured in bank-grade hardware security modules.Private keys never leave the secure environment,and all transactions require multiple authorizations.

Innovative Practice

SwissOne applies the strategies of prestige finance to crypto and Blockchain assets. Our Funds are designed to outperform the general market.

Our Funds

Smart Top 50 Crypto Index

A Top 50 Crypto Smart Index strategy providing investors with the ultimate go-to product for portfolio exposure to this emergent asset class. Consistently allocating capital to top performing assets over time.

Smart Metaverse ETI

A smart parameter strategy designed to encompass the early growth potential of the Metaverse with a diverse spectrum of assets including Crypto and Listed Equities.

Blockchain Listed Equity Fund

A traditional fund comprising of listed equities with exposure to blockchain assets and blockchain related industry and technology.

Industry Leading

Crypto Security

SwissOne enriches crypto investing with military-grade asset security. Provided by Swiss based Crypto Finance AG, in partnership with their storage provider Crypto Finance AG.

Security of the underlying assets is a core focus of SwissOne, which is why all trades are performed by Crypto Broker AG, who provide a secure, best execution service.

The majority of assets are kept in secure storage 24/7, except during the rebalancing during which a portion of assets are removed from secure storage for a maximum of 3 days.

Military Grade Hardware

Custom developed, redundant Hardware Security Modules (HSMs) form the backbone of the storage solution.

Private Keys Never Accessible

All private keys are generated within the HSM, and never leave the secure environment. All signing of transactions are performed within the HSM

Multi-Signature Authorizations

Transaction approval is performed by multiple parties on custom built, dedicated, secure, tamper proof authorization terminals.

Pre-Authorized Wallets

Transfers are only allowed to pre-authorized destinations (wallets), thus eliminating employee fraud.

Partners & Sponsorships

SwissOne Capital Provides Extra Airtime For A Promising Young Gun Freeskier

We are stoked to announce that we support the education of 14 year old Lenny Bondarenko - one of Europe's most promising young talents in freeski- at the CJD German Sport Elite Boarding School in Berchtesgarden.

Niclas Grönholm Rally Car Driver

Niclas Gronholm is a 25-year-old, six-time World Rallycross Championship race- winner.

Polo Park & Country Club

SwissOne sponsors the Polo Park & Country Club in Zurich along with the Los Lobos Polo Team.

Our Partnership with Home of Blockchain.Swiss Initiative

We've partnered with Home of Blockchain.swiss to assist it in its goals of making foreign companies aware of the many strengths and advantages Switzerland has to offer to the International blockchain community

Insights